Insurance repair standards are vital for ensuring fairness, consistency, and quality in vehicle damage settlements. They serve as uniform guidelines for collision repair shops, promoting transparency and high-quality workmanship. These standards simplify assessment processes, reduce disputes, and benefit both policyholders and insurance companies by minimizing administrative costs. Implementation fosters trust among all parties, protecting consumers from overcharging or substandard work and ensuring only qualified technicians are involved in repairs.

In the intricate landscape of insurance claims settlements, insurance repair standards play a pivotal role in ensuring fairness, accuracy, and quality. These benchmarks guide the restoration process, dictating how damaged properties are repaired or replaced. Understanding their significance is crucial for policyholders, as it directly impacts settlement outcomes. This article delves into the critical aspects of insurance repair standards, elucidating their effect on claim processing and emphasizing their role in maintaining integrity within the industry.

- The Significance of Insurance Repair Standards

- How These Standards Impact Settlement Processes

- Ensuring Fairness and Quality Through Implementation

The Significance of Insurance Repair Standards

Insurance Repair Standards play a pivotal role in ensuring fairness and consistency during settlement processes for vehicle damage repairs. These standards act as a benchmark for collision repair shops to follow, guaranteeing that every vehicle undergoes thorough assessment and receives quality care. By setting specific guidelines, insurance companies can maintain high-quality workmanship while controlling costs. This is particularly crucial when dealing with complex car damage repair cases involving intricate vehicle bodywork.

The adherence to these standards fosters trust between insured parties, insurance providers, and collision repair shops. It promotes transparency, as everyone involved knows the criteria used to evaluate and approve repairs. Moreover, it safeguards consumers from potential overcharging or substandard work by ensuring that only authorized and qualified technicians handle their vehicle bodywork.

How These Standards Impact Settlement Processes

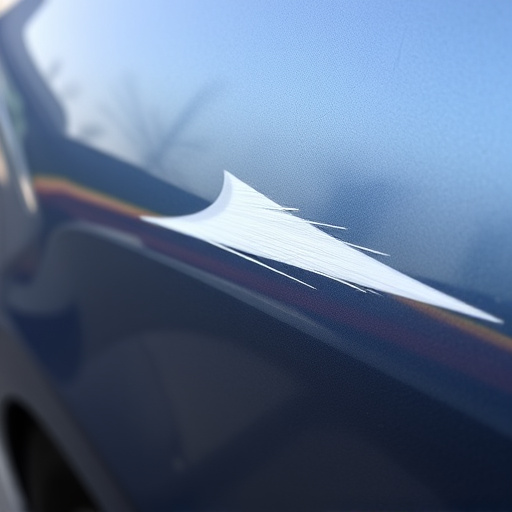

Insurance repair standards play a pivotal role in shaping the settlement processes for various types of damage, particularly in the realm of auto body repairs. These standards act as guidelines that dictate the quality and methods employed during restoration work, ensuring that repairs are carried out to a high and consistent level. When an insurance claim involves car repair services or auto body restoration, assessors refer to these standards to determine the feasibility and cost-effectiveness of proposed solutions.

By establishing uniform criteria for fender repair, for instance, standards help in mitigating disputes between policyholders and insurers. They provide a clear framework for appraisers to evaluate damage, making it easier to agree on the necessary work and its corresponding costs. This streamlined process facilitates faster settlements, benefiting both parties involved—policyholders get their vehicles repaired efficiently while insurance companies minimize administrative overheads.

Ensuring Fairness and Quality Through Implementation

Implementing insurance repair standards plays a pivotal role in ensuring fairness and quality across the board when settling claims for auto collision repairs. These standards act as a benchmark, dictating the procedures and specifications that reputable car repair services must adhere to. By establishing uniform protocols, they guarantee that vehicle repair work is conducted meticulously, preserving the integrity of both new and refurbished parts.

This standardization fosters trust between policyholders, insurance providers, and auto body shops. When repairs are performed according to these guidelines, it ensures that customers receive high-quality car repair services without compromising their safety or vehicle performance. Furthermore, it protects honest businesses from unfair competition, fostering a fair market where quality work is rewarded, ultimately leading to better outcomes for all parties involved in the settlement process.

Insurance repair standards play a pivotal role in ensuring fairness and quality during settlement processes. By setting clear guidelines, these standards help appraisers and adjusters make accurate assessments, leading to more transparent and just outcomes for all parties involved. Understanding and implementing these standards is crucial for streamlining settlement procedures and fostering trust among stakeholders in the insurance industry.